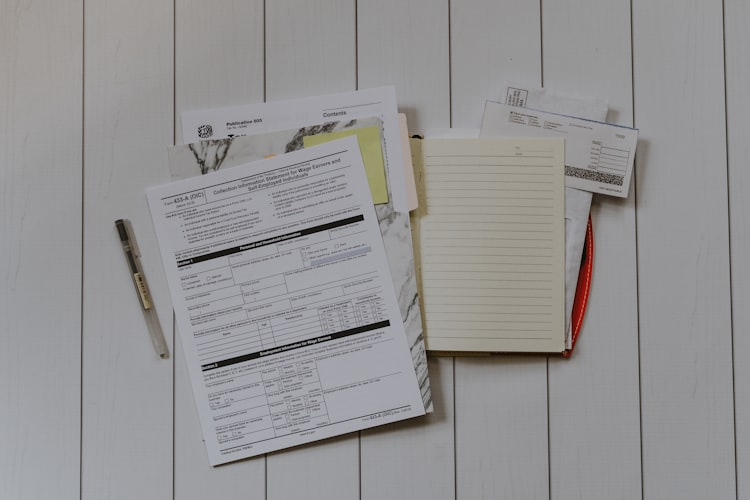

"Because tax-favored retirement accounts are supposed to be for

retirement, the rules often impose tax and a 10% penalty on withdrawals

before age 59½. Younger IRA owners who take out up to $10,000 to

purchase a first home don’t owe the penalty, while younger 401(k)

participants do."

"Because tax-favored retirement accounts are supposed to be for

retirement, the rules often impose tax and a 10% penalty on withdrawals

before age 59½. Younger IRA owners who take out up to $10,000 to

purchase a first home don’t owe the penalty, while younger 401(k)

participants do."“The IRA and 401(k) rules are full of these booby-traps, and they hurt a lot of smart people who aren’t retirement experts,” says Natalie Choate, an attorney and retirement-plan specialist.

Education-expense withdrawals. Payouts before age 59½ from an IRA that are used for higher-education tuition, books and other costs are exempt from the 10% penalty. Similar withdrawals from 401(k) plans incur it.

Age 55—59½ payouts. Savers don’t owe the 10% penalty on withdrawals from a 401(k) before age 59½ if they were at least 55 in the year they left their job. But a 10% penalty applies to IRA withdrawals before the owner is 59½, except for certain exemptions.

Borrowing. Many 401(k) plans allow participants to borrow from them. Borrowing against an IRA is prohibited.

Creditor protection. Employer-provided plans such as 401(k)s are better shielded from creditors than are IRAs.

No comments:

Post a Comment