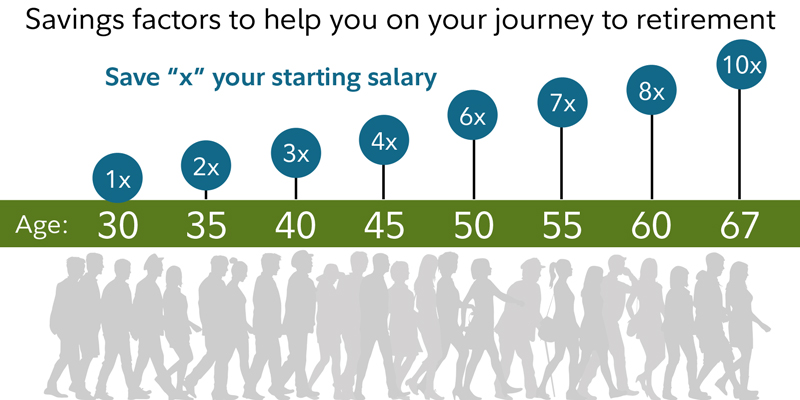

While there are many variables affecting how much you will need to live on in retirement, no one wants to be caught short. You can borrow money for college but not for retirement. (aside from the option to take a reverse mortgage against your house). Fidelity investments provides some aspirational guidelines to help.

"Our savings factors are based on the assumption that a person saves 15% of their income annually beginning at age 25 (which includes any employer match), invests more than 50% on average of their savings in stocks over their lifetime, retires at age 67, and plans to maintain their preretirement lifestyle in retirement."

By age 30 you should have accumulated one time your salary; If you're not there yet it may be time to boost your savings. And when I refer to "saving" for retirement I really mean investing.

Details at: https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire

No comments:

Post a Comment