December 27, 2022

Help in hiring financial professionals

The costs of underpaying federal income taxes

You need to pay most of your tax during the year, as you receive income, rather than paying at the end of the year.

There are two ways to pay tax:

- Withholding from your pay, your pension or certain government payments, such as Social Security.

- Making quarterly estimated tax payments during the year.

To avoid paying a penalty for underpaying federal income taxes a taxpayer needs to have paid by the end of the tax year (12/31/22 for employees or 1/17/23 for those making estimated payments) 90% of what they owe.

Check your withholding or quarterly estimated taxes (for retirees or self-employed).

Check your withholding often and adjust it when your situation changes. To do this fill out a new Form W-4 and give it to your employer. The Tax Withholding Estimator is a helpful tool.

Due to inflation the interest on the penalty for underpayment of taxes is currently 6%, by January 1, 2023 it will rise to 7%, much higher than the 4% at the beginning of 2022.

Charitable deductions

There is no $300 or $600 donation deduction for non-itemizers (as applied in 2020 and 2021).

Standard Deduction

For 2022, the standard deduction for married couples filing jointly is $25,900 and $12,950 for single filers. These amounts will increase in 2023 to $27,700 and $13,850. Filers age 65 and older get an additional deduction of $1,400 in 2022 and $1,500 in 2023.

Shorter showers are better for the environment and your skin

As we hear about the skyrocketing cost of energy in Europe, and the fewer, shorter showers many Europeans are taking, it's time to consider the typical American shower.

Reasons why we should take fewer, shorter showers:

#1. It’s better for your skin.

It’s true that long, hot showers may feel restorative, but they can dry and

irritate the skin. Hot water strips away natural oils that are needed to keep

the skin hydrated.

Warm water rather than hot is better for your skin. After showering, pat yourself dry instead of rubbing vigorously with a towel. Then, apply moisturizers to keep your skin hydrated.

#2. It’s better for the environment and saves money.

For Americans, the average shower lasts about 8 minutes, according to the

Environmental Protection Agency. That’s 20 gallons for every average shower,

based on the standard showerhead using around 2.5 gallons of water per minute.

You can save a lot of water and energy if you shave off a few minutes of your showertime. Showers rather than baths also helps save water because an average bath uses up 35 to 50 gallons of water.

Other ways of conserving water include replacing your showerhead for one with a WaterSense label. Not only can it help save 2,700 gallons of water per year, but it also reduces demands on water heaters and saves energy—330 kilowatt hours of electricity annually, which is enough to power a house for 11 days.

And instead of waiting for the shower to warm up, collect the water to use on house plants or your yard. You can also read here for other ways to cut your water usage in half.

Source: Consumer Reports

Student loan debtors are left in limbo

Millions of Student Loan Holders Face Debt Forgiveness Uncertainty in 2023

Supreme Court will hear the challenge to President Biden’s loan cancellation plan in February.

Writing for The Wall Street Journal, December 27, 2022, Gabriel T. Rubin explains that the Supreme Court will hear the case regarding the Biden Administration's debt cancellation plans on February 28, 2023. However, it could be months before a decision is made public.

In the meantime, the safest thing to do is to start or continue putting aside the monthly amount owed in an online savings account (some paying 3%!) to get used to the expense. If in the unlikely situation where the conservative majority on the court rules against student loan forgiveness, you will have a bit of savings to boost your emergency reserves. If, as expected, the Supremes rule against loan forgiveness you will be used to making those payments again.

Regardless of the outcome, what hasn't been addressed is the skyrocketing cost of higher education.

As one example of factors contributing to high college costs, the retiring president of Utah State University, Noelle Cockett, will be paid $500,000 (no joke) for a year of sabbatical leave once she steps down in the shadow of multiple sex assault scandals on campus.

How did stocks perform in 2022?

Overall, the S&P 500 fell by 19 percent in 2022.

It will probably be one of the 10 worst performing years for the stock index in at least 90 years.

But keep in mind that you probably started investing in stocks well before January 2022. Look at your returns over the long run before panicking.

Because a major stock index is down almost 20% now is a great time to invest for long term goals like retirement. We've all heard the advice "buy low, sell high." Now is a chance to buy when prices are low (relative to the recent past).

Rather than trying to time the market, set up a regular automatic monthly deposit into your investment and retirement accounts. No one can consistently time the market by guessing exactly when to buy and sell.

This is what we mean when we say stocks are "risky." Actually it's more accurate to say that stock prices can be very volatile. That's why you don't want your emergency reserve funds, or money you expect to need in the next 3-5 years, held in stocks.

I bonds, U.S. Government inflation-adjusted bonds are a great place for your emergency savings, vehicle replacement fund, and other short to medium range goals.

Just be glad you didn't buy Tesla stock at its peak in November 2021. The stock has lost 70% of its value since then. Another good reason to have a widely diversified investment portfolio. Don't put all your eggs, or even most of them, in one basket.

The S&P 500 is up 19 percent since 2020!

If you want to feel better about your investments, you’ll need to go back to the start of 2020. Stocks have rebounded considerably from the brutal bear market at the start of the pandemic.

Steps to Take Now to Get a Jump on Your Taxes

Tax planning is for everyone. Get ready today to file your 2022 federal income tax return. Planning ahead can help you file an accurate return and avoid processing delays that can slow your tax refund.

The IRS has a webpage to get you prepared to make income tax filing as painless as possible. check out: https://www.irs.gov/individuals/steps-to-take-now-to-get-a-jump-on-next-years-taxes

Topics included in this web page include information for individuals and businesses.

Steps you can take now to make tax filing easier in 2023

What's new and what to consider when you file in 2023

December 21, 2022

Think twice before "Buy Now, Pay Later" tempts you

Advice from the Consumer Financial Protection Bureau

For holiday shopping, and for post-holiday sales, in stores and online, more and more people are turning to Buy Now, Pay Later arrangements. A typical Buy Now, Pay Later payment schedule splits your purchase amount into a specified number of payments. For example, you pay the first one at checkout, and then one payment every two weeks for six weeks.

Using Buy Now, Pay Later can be convenient, and usually free from interest charges. Still, if you choose Buy Now, Pay Later, there are a few things you may want to watch out for.

- Because you can make multiple Buy Now, Pay Later purchases through different services or merchants in a short time, it’s easy to end up with more debt than you intended, or can afford.

- Buy Now, Pay Later products generally require your installment payments to be automatically paid, typically debited from your bank account. In contrast, with other loans lenders generally send you periodic statements and grant you a grace period for repayment, so those loans give you more control over which bill to pay when, and what payment method to use.

- Some Buy Now, Pay Later services charge multiple late fees for a single missed payment, or try more than once to collect automatic payments from your checking account if they don’t go through. This could mean you pay higher late fees than you expected or incur multiple overdraft fees.

- Many Buy Now, Pay Later services and apps use your data and shopping history to encourage you to buy more, and spend more.

- If you return an item, Buy Now, Pay Later companies may still end up taking regular payments for the full amount of the loan. And, because there are three different companies involved – the Buy Now, Pay Later company, the seller, and your financial institution – it can be challenging and stressful to resolve a problem.

You can get more facts about Buy Now, Pay Later purchases on our site:

Thank you,

Office of Financial Education

Consumer Financial Protection Bureau

December 20, 2022

CFPB Orders Wells Fargo to Pay $3.7 Billion for Widespread Mismanagement of Auto Loans, Mortgages, and Deposit Accounts

Why would anyone continue to do business with Wells Fargo? They have a LONG history of abusing consumers! The highest level of management has repeatedly forced their employees to take advantage of consumers resulting in appalling situations... repeatedly... time and time again.

If you are a Wells Fargo customer, the #1 item on your to-do list is to find a financial institution that will treat you as a valued customer rather than a schmuck to take advantage of. Most consumers can join a Credit Union which is consumer owned rather than a bank that is beholden to stockholders.

"The Consumer Financial Protection Bureau (CFPB) is ordering Wells Fargo Bank to pay more than $2 billion in redress to consumers and a $1.7 billion civil penalty for legal violations across several of its largest product lines. The bank’s illegal conduct led to billions of dollars in financial harm to its customers and, for thousands of customers, the loss of their vehicles and homes."

"Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank. Wells Fargo also charged consumers unlawful surprise overdraft fees and applied other incorrect charges to checking and savings accounts. Under the terms of the order, Wells Fargo will pay redress to the over 16 million affected consumer accounts, and pay a $1.7 billion fine, which will go to the CFPB's Civil Penalty Fund, where it will be used to provide relief to victims of consumer financial law violations."

Pay attention to the REAL news, not Tik Tok or Facebook or YouTube. Check out this story from NPR: https://www.npr.org/2022/12/20/1144495984/wells-fargo-to-pay-3-7-billion-over-mistreatment-of-its-customers

December 15, 2022

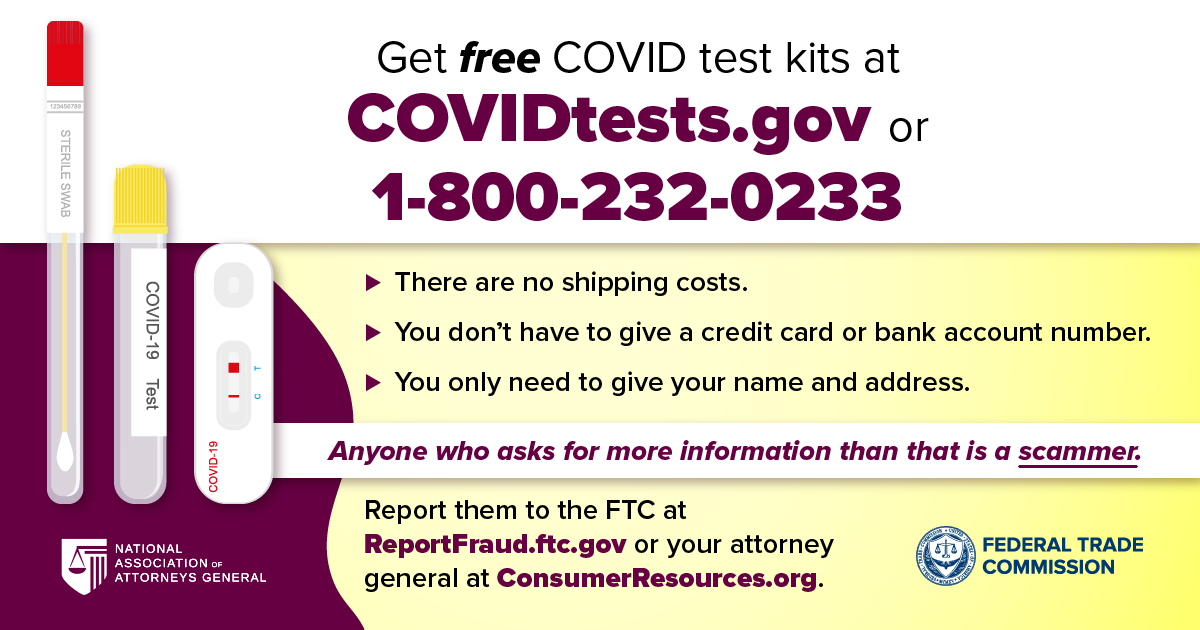

Free at-home Covid test kits

My husband and I discovered how expensive it is to get Covid when far away from home. We flew from Utah to Maryland to visit his 93-year-old mother on November 30. We ended up having to stay an extra week at $180/night (+ tax) plus extra days on the rental car, etc. Luckily neither of us got very sick and we were right next to a Walgreens where we could buy Covid tests for $24 for 2 tests which don't go far with two of us, especially with the need for multiple days of testing. So add another $100. We finally got home last night. Our car developed a windshield crack while parked at the airport. No idea why as there were no chips or other problems. Welcome home!

This morning we found out via NPR that we can once again order 4 free home Covid tests from the government at https://www.covid.gov/tests in preparation for the holidays.... So I ordered and now we are prepared for the next occasion.

How did we get Covid? We are both fully vaxed and booster. We took extra precautions to avoid infection in the 10 days before we left to see his mother. The only way we could have gotten infected was on the airplanes (most likely) or in one of the airports. We were among the 5% wearing masks which we only took off to eat or drink on our 10 hour trip (long layover in Denver). My husband got infected and passed it along to me.

Happy holidays! Pack your Covid test kits, thermometer, and extra credit cards. I can guarantee that if you are flying you will be exposed to Covid.

December 14, 2022

Considering Buying Property in the U.S? Want to know the fire, flood, and heat risks of your current home or vacation property?

Thinking about relocating? Seeking a new location for retirement? Buying a vacation home? Want to know the risks you face in your current location?

Our changing climate is causing more properties to be at risk of fire, flood, or extreme heat. Risks are increasing across the U.S. The information at this website can help you make a wise decision about investing in a property and show you projections of the increasing future risks. Beyond the potential financial risks, your life and health are affected by where you live.

Find your home's environmental risks from flooding, wildfire or extreme

heat. See historic events, current risks, and future projections based

on peer-reviewed research from the world's leading climate modelers.

Check out the Risk Factor for a specific address, zip code, city or county at: https://firststreet.org/risk-factor/

A property’s Flood Factor, Fire Factor, and Heat Factor indicate its comprehensive risk from flooding, wildfire, or extreme heat ranging from 1 (minimal) to 10 (extreme).

Risk Factor is a free tool created by the nonprofit First Street Foundation to make it easy to understand risks from a changing environment. Learn more about Risk Factor.

A terrible guide to the terrible terminology of U.S. Health Insurance

A 30 minute YouTube video offers some down-to-earth advice for navigating options with a strong dose of humor.

As deadlines approach to enroll in Affordable Care Act coverage, a 30-minute YouTube video on health insurance terms by Brian David Gilbert should prove helpful.

A terrible guide to the terrible terminology of U.S. Health Insurance...

explains deductibles, coinsurance, and all the other jargon you need to understand the complex aspects of private health insurance in America.

December 6, 2022

Most Colleges Give Inaccurate Price Details in Financial-Aid Letters, Federal Report Finds

"GAO blasts poor disclosures to students, calls for legislation standardizing cost and aid information," according to The Wall Street Journal (12/6/22) writer Melissa Korn.

According to the Government Accountability Office (GAO), most schools provide "woefully inadequate and even misleading" information to prospective students.

I noticed this problem with my niece's college aid offers that listed federal student loans as "financial aid" in the same column with actual scholarships (that don't require repayment), implying that loans requiring repayment fit in the same category. And we all know how controversial student loans are as the burden for many students, especially those who borrow but don't graduate, is often far more than anticipated.

"Aid letters that are supposed to lay out tuition, fees and other expenses, and what grants, loans and other financing options are available to cover those costs, lack crucial information that would allow families to compare institutions. At their worst, some financial aid offer letters lead students to enroll in schools they can’t afford."

"One of the most troubling findings from its review, the GAO said, was that 91% of schools don’t properly list their net price, or the amount a student is expected to pay for tuition, fees, room, board and other expenses after taking into account scholarships and grants."

December 2, 2022

Financing Post-Secondary Education

Options for financing higher education should start with subsidized federal loans which provide the most extensive consumer protections. See https://studentaid.gov/. Further, it is often prudent to limit borrowing to the maximum amounts allowed from the federal government. Loans from private lenders don't offer the same consumer protections so tread carefully. Check out links to student debt and student loans on this searchable blog for more info.

One option for non-government student loans and refinancing is Education Loan Finance: https://www.elfi.com/

A Guide to Resources for Seniors and Retirees

This website provides information and inks to resources for seniors and retirees. Topics include:

Combatting Nursing Home Abuse

"Every year, nursing home abuse brings physical, emotional, or financial harm to older Americans. The perpetrators are usually negligent staff members or other residents. To protect loved ones in nursing homes, family members should check in regularly and report warning signs of abuse. Residents and their families may also qualify for compensation if abuse occurs."

Find out more at: https://www.nursinghomeabusecenter.com/nursing-home-abuse/

Financial Life Hacks For High Schoolers and Young Adults

Finances may be a dull yet essential part of life, mastering you money opens pathways to achieveing your goals and to your future. Financial literacy is "having a basic

understanding of your money, where it's coming from, and where it's

being spent."Read on to learn more.

"Whether you are living paycheck to paycheck or looking to make money from your savings, learning how to become more financially literate will only help you down the line. With the average American having $9,000 less in their bank accounts in 2022 compared to 2021, we think it's time we all became better with our money. Join us, and we'll make the mundane task of money management a little easier and a bit more fun." Check out https://word.tips/financial-education/ for some great resources to help you conquer your money challenges and achieve your financial goals. While the site is geared to teens, much of it is relevant for adults of all ages.

Learn about taxes and credit and link to useful apps. Once you start working it's time to build a rainy day fund with the help of this website. Sam Walker-Smart leads you on your journey.

November 25, 2022

How to erase your eviction record in Utah (in English and Español)

From the Salt Lake Tribune Investigative Journalism Team

(Para leer el texto en español vaya a la mitad del artículo.)

By Eric S. Peterson, Silvia Nuila and Frank Regalado

"Have you ever been evicted? Do you wish it never happened? Thanks to a new law in Utah, you might be able to make it disappear from your legal record.

Tens of thousands of Utahns over the years have been evicted from their apartments and homes. It’s not a crime to get evicted. It’s not a crime to miss rent because you lost your job or ran out of money paying medical bills or fixing a broken car. It’s not a crime if you miss rent because you are just trying to get through difficult times.

But having an eviction on your record can be as bad as having a crime on your record. It can hurt your credit score, making it harder for you to get a loan for a car or to get into your dream home. And your rental application for a nice new apartment might get rejected if the landlord sees you have an eviction on your record—even if it happened years ago.

But state law allows Utahns to expunge... an eviction from their records; in other words, evictees can wipe the slate clean as if it never happened. Even better? There’s no cost to do it."

Read the full article at: https://www.utahinvestigative.org/how-to-erase-your-eviction-record-in-utah-in-english-and-espanol/?doing_wp_cron=1669399398.6307051181793212890625

Where to find more help

Utah Courts Self Help Center: For help filing documents. utcourts.gov/selfhelp, 888-683-0009

Utah Housing Coalition: Can help walk you through the process and find legal and other help. Online at utahhousing.org or call 801-364-0077.

The Legalese of Expungement

Civil Cover Sheet: Your basic application to the court to ask for expungement.

Expungement: Erasing your eviction record.

Satisfaction of Judgment: Paying your old eviction debts so you can expunge your eviction.

Petition: A written request, asking the court to do something.

Proof of Service: Document showing you sent your petition to your landlord. It could be in the form of a certified mail receipt.

November 24, 2022

Planning to move to a disaster-prone dream locale?

A small but growing number of people are taking climate change into account when choosing where to live. Armed with climate studies, movers can identify locations that are less likely to experience extreme weather events, such as wildfires, drought and flooding.

Because they are older, retirees are particularly at risk during climate-induced disasters.

"Extreme weather can be particularly dangerous, and even deadly, for the elderly, who are more likely to have chronic medical conditions and disabilities, according to numerous studies."

"Three-quarters of residents who died in the 2018 Camp fire, which destroyed the Northern California community of Paradise, were 65 and older. Well over half of the record-high 323 people who died from heat-related causes in Arizona’s Maricopa County in 2020 were at least 50. And two-thirds of the people who died in Florida during Hurricane Ian in September were 60 and older."

Resources are available to assess the climate risk of your current home or places you are considering moving to for work or retirement.

The National Oceanic and Atmospheric Administration’s Climate.gov provides data on floods, wildfires, drought, wind, disease and other climate hazards.

Current and prospective buyers can check out specific properties. "Risk Factor provides data on anticipated wildfire, flooding and extreme heat risks for 145 million properties in the United States over the next 30 years."

"Each property is ranked for each type of risk on a scale from 1 (minimal) to 10 (extreme). The online tool provides a percentage likelihood of the risk occurring over time — for example, that floodwaters could reach your house in the next five or 10 years or that the community could experience a certain number of 100-degree days. (ClimateCheck also provides property-specific risk data on heat, drought, fire, flood and storm.)"

Some real estate agencies provide climate risk projections. First Street Foundation, the nonprofit that developed Risk Factor,is useful to current homeowners as well as prospective buyers. Once you know your current risk you can take action to minimize the risk from climate-related disasters.

Buyers who choose to move to a risky area should first explore the costs of hurricane windows, flame-resistant roofs, energy-efficient air-conditioning, home elevation and repairs from wind damage or flooding.

Before buying, "ask several insurance companies about the cost and availability of homeowners’ coverage. Premiums are rising considerably in communities prone to wildfires, hurricanes or flooding, and many insurers are not renewing policies, limiting coverage or pulling out of high-risk markets."

Source:‘Do You Really Want to Rebuild at 80?’ Rethinking Where to Retire.

By Susan B. Garland, New York Times

November 23, 2022

Why are Property Insurance Rates Increasing Faster than Inflation?

Climate-related disasters cost all of us, even when we are not directly affected.

"The National Oceanic and Atmospheric Administration tracks weather-related disasters in the U.S. that cause more than a billion dollars’ worth of damage. According to NOAA:

In the 1980s, the U.S. saw an average of 3 such disasters per year.

In the 1990s, the average was 5 per year;

In the 20002, it was 6;

In the 2010s it jumped to 12. (The $ amounts are been adjusted for inflation.)

In 2020, a record-shattering 22 disasters costing more than a billion dollars struck the country.

In 2022 we are on pace to match that record, with 15 such disasters by October, including Hurricane Ian, which is likely to prove one of the most expensive storms in American history.

Adam B. Smith, a NOAA researcher, has written that a disastrous number of disasters “is becoming the new normal.” The rise is partly a function of more people living in vulnerable areas, such as floodplains. But increasingly it’s a function of climate change."

"In the future, the costs may climb steeply or they may climb precipitously. All our infrastructure has been built with the climate of the past in mind. Much of it will have to be rebuilt and then, as the world continues to warm, rebuilt again."

Comment: Now is NOT a good time to buy South Florida real estate... or coastal property anywhere. Climate change/disruption is here now; not sometime in the future. And it is costing all of us in the form of higher property insurance rates (even if we live far from these disasters because insurance companies spread the costs) and because our state and federal taxes help alleviate the damage once it occurs. The tax dollars spent on disasters could provide other services to Americans.

Data source: The New Yorker, Climate Change form A to Z, by Elizabeth Kolbert

Make a Holiday Spending Plan... and Stick to It!

If you carry a balance on your credit cards, this post is not for you. Go to https://extension.usu.edu/powerpay/ and focus on paying off your credit cards and other high interest debt.

1. Set your limits

2. Put money aside

3. Start buying as soon as possible

4. Buy or make creative or sentimental gifts

5. Don't spend money you don't have

6. Start in January to get a head start on next year's giving

November 22, 2022

Crypto... can be toxic as FTX demonstrates

I've refrained from discussing crypto because there is no real "there" there... no company doing any business we could understand. No product being produced, no services offered to consumers. NOTHING! and people were willing to invest lots of money. Sigh.

News about the collapse of FTX has been all over The Wall Street Journal for weeks. Each article reveals more appalling aspects of how money was stolen from crypto investors.

I couldn't resist adding this from 12/16/22 WSJ: "In 2017, Warren Buffett's longtime business partner Charlie Munger, said of Crypto: "I'm proud of the fact that I avoided it. It's like a venereal disease or something."

Another reason to avoid Crypto: It consumes VAST amounts of electricity!

"Sam Bankman-Fried Ran FTX Like a Personal Fiefdom, Lawyers Say. In bankruptcy court, the crypto exchange’s attorneys said a ‘substantial amount’ of the firm’s assets are stolen or missing."Alexander Saeedy and Jonathan Randles, WSJ, Nov 23, 2022.

"FTX's Sam Bankman-Fried cashed out $300 Million during funding spree. Nearly three-quarters of the $420 million that FTX raised in a fundraising blitz last year went to founder Sam Bankman-Fried, who sold some of his personal stake in the company." WSJ 11/18/22.

"FTX Crypto customers Worry They Will Never See Their Money Again. FTX lawyers have said that in all there could be more than 1 million creditors across FTX's various entities. Beleaguered crypto customers are beginning to lose hope."

"If there is a silver lining to the rapid and dramatic collapse of the cryptocurrency exchange FTX, it’s that it might lead to some long-awaited bipartisanship in Congress — to pass long-needed regulation of Big Tech."

My advice if you own crypto: Sell and invest in a real company that produces products and/or services.

November 16, 2022

Inflation means higher interest on online savings accounts

If you still have substantial amounts sitting in a bricks and mortar bank or credit union, it's time to check out rates at online institutions.

Check out online savings accounts at CIT Bank, Synchrony, Marcus and American Express. CIT is currently paying 3.25%, Synchrony 3%, Marcus 3% and American Express 2.75%. The rates have climbed so frequently this year that they’ll probably be higher by the time you read this.

Bankrate.com is the go-to place for comparing interest rates for both saving and borrowing: https://www.bankrate.com/

More information at: https://humbledollar.com/money-guide/higher-bank-yields/