Yes, higher prices are a drag but why are you leaving your savings in 0.05% (or less) savings accounts?

Inflation-adjusted U.S. Savings Bonds are the best way to beat inflation. Currently these bonds are paying 7.12% (through April 30); the rate will escalate to 9.6% May 1. Generally one is limited to buying a maximum of $10,000 of I-bonds each year but you get get up to $5,000 more if you purchase bonds with your income tax refund (but only if you are owed a refund).

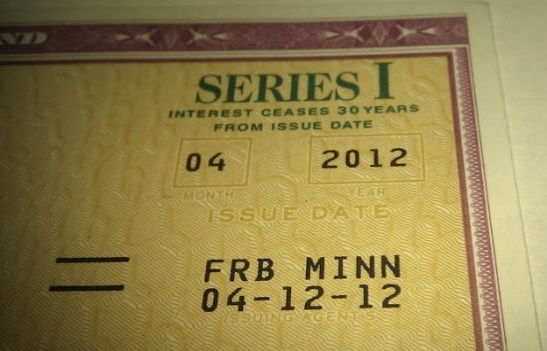

If you purchase I-bonds with a federal tax refund you will be issued paper bonds. All other direct purchases of I-bonds are in electronic form through a Treasury Direct account. Tax-refund I-bonds are available in $50 increments and you can decide how much to buy and have the rest of your refund deposited in your bank account. You can convert paper bonds to electronic form via the Treasury Direct website: https://www.treasurydirect.gov/. Details on I-bonds are at: https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm.

Review the basics by searching this blog for I bonds.

No comments:

Post a Comment