The latest study by FINRA of Americans' financial practices, the "State-by-State Financial Capability Survey" reveals:

-"Fewer than half, 41%, of Americans spend less than they make.

-Over a quarter, 26%, have unpaid medical bills and those under 34 years

old are more likely to have them than those who are older.

-More than half, 56%, have no rainy-day savings enough to cover surprise

financial distress.

-Over a third, 34%, pay only the minimum amount on their credit cards.

-Younger Americans are more likely to show signs of financial stress.

-Of five basic questions about personal finance, the national average was

2.88 correct answers."

The full survey report is available at

www.usfinancialcapability.org.Authority

All the more reason to attend Financial Planning for Women and get reinforcement for your positive behaviors!

May 30, 2013

How do you stack up on financial practices?

529 College Savings Plans is topic for July 10 FPW

Most Americans don’t know what a

529 college savings plan is, according to a survey by Edward Jones. The tax-advantaged

investment plans facilitate saving for tuition and other costs while

benefitting from a variety of tax breaks. Not surprisingly the study revealed

that wealthier Americans know more about 529 plans than less affluent

respondents. Although ideally suited to long term saving for a child’s

education (usually by parents, grandparents, and other relatives), 529 plans

can be used by adults as well. Come to Financial Planning for Women on

Wednesday, July 10 at 11:30 or 7 pm to learn more. Check the other blog posts

for info on 529 plans by searching for “college savings” and “529.”

May 29, 2013

Aging Parents and Children Should Talk About Finances

“Children may be reluctant to ask aging parents about their

estate and financial affairs, but information shared can prevent confusion

later.” Read the details on NYTimes.com by Tara Siegel Bernard.

http://nyti.ms/10Y2aBp

May 28, 2013

Forget the 3-legged stool: Multi-level pyramid + strategic SS claiming

“Time to replace the three-legged-stool myth; a multilevel pyramid is a better analogy for retirement income.” “The pyramid consists of five components: Social Security, homeownership, employer-sponsored retirement plans, individual retirement accounts and other assets.” The author suggests adding part-time employment, as well. Retirees should consider spending some of their retirement investments in the early years of retirement and “deferring Social Security benefits until they are worth more later.” For example, “Financial Engines research showed how a newly retired married couple, where the wife is 62 and the husband is 66, could boost their potential lifetime Social Security income by more than $130,000 by exercising some creative claiming strategies.”

The September 11 Financial Planning for Women speaker, planner Suzanne Dalebout, will address how to maximize Social Security benefits through strategic decisions on when to claim benefits. Each year of delaying SS benefits results in an 8% increase in the monthly benefit so it can be prudent to spend retirement funds in IRAs and employer sponsored funds first in order to claim a larger Social Security payout by delaying receipt of benefits. Mary Beth Franklin explains the new approach in the Investment News; she also writes for Kiplinger Personal Finance Magazine, one of my favorite information sources. http://www.investmentnews.com/article/20130526/REG/130529945

May 25, 2013

Millennial: In debt and NOT saving for retirement

“Young Americans are more focused on paying off debt

than they are on saving for retirement, and that can be a mistake, experts say.

Those ages 22 to 32 can miss the chance to ride out market fluctuations if they

don't invest early, says Karen Wimbish of Wells Fargo. A survey by Wells Fargo

shows that 87% of millennials say they have too little money to save. ‘That's

concerning," Wimbish says, "because this generation, more so than any

other before them, is going to be primarily if not solely responsible for

whatever their retirement looks like.’”OnWallStreet.com

Labels:

retirement planning,

young adults

Squared Away: Best blog for reliable financial planning info

You'll note that many of my blog items direct you to the source: The Squared Away Blog from the Center for Retirement Research at Boston College. Squared Away provides reliable research-based information. Check it out on a regular basis and sign up for occasional emails at http://squaredawayblog.bc.edu/

How many retire on their own terms?

Half (52%) of workers born in 1946 are fully retired. “Of

those who are fully retired, 38 percent said they were ready to retire (they

wanted to be through with work), 17 percent said they retired for health

reasons and 10 percent said they lost their jobs. The rest retired for other

reasons -- simply because they could afford to or because they wanted to join a

retired spouse.” So more than one-fourth did NOT retire on their own terms but

were “forced” into quitting by poor health or job loss. So not everyone gets to

call the shots as to the terms of when to retire. Fully 43% report starting to

collect Social Security benefits “earlier than planned.” And “only 20 percent

feel good about their personal finances.” Check out the MetLife Mature Market

Institute’s report: "Healthy,

Retiring Rapidly and Collecting Social Security: The MetLife Report on the

Oldest Boomers." http://www.fa-mag.com/news/half-of-oldest-boomers-retired-14380.html

Labels:

early retirement,

retirement

May 17, 2013

Americans want to strengthen & pay for Social Security, not cut it

According to a new study, "Support for Social Security is particularly strong among African

Americans and Hispanics, according to a brief released today by the

nonpartisan National Academy of Social Insurance (NASI). Strengthening Social Security: What Do Americans Want: Views Among African Americans, Hispanic Americans, and White Americans

finds a sharp contrast between what Americans say they want and changes

being discussed in Washington, such as cutting benefits by using a

“chained” Consumer Price Index (CPI) to determine Social Security’s

cost-of-living adjustment (COLA)."

“A true test of Americans’ support for Social Security is their willingness to pay for it,” said Jasmine Tucker, Senior Policy Analyst at NASI and author of the brief. “Americans across racial and ethnic groups say they don’t mind paying Social Security taxes because the program helps millions of people and because they and their families benefit from it." Read the brief at http://www.nasi.org/sites/default/files/research/Views_Among_African_Americans_Hispanic_Americans.pdf

“A true test of Americans’ support for Social Security is their willingness to pay for it,” said Jasmine Tucker, Senior Policy Analyst at NASI and author of the brief. “Americans across racial and ethnic groups say they don’t mind paying Social Security taxes because the program helps millions of people and because they and their families benefit from it." Read the brief at http://www.nasi.org/sites/default/files/research/Views_Among_African_Americans_Hispanic_Americans.pdf

3 skills teens need to learn about money

"The

most important money-management skills to teach teenagers are how to

manage a limited budget, how to save a portion of income and how to

avoid building up credit debt, Karen Cheney writes.

Get teens set up with a bank account and debit card and let them manage

their expenses for clothes and entertainment, for example, and get out a

calculator to show how compound interest works." Learn more at:

http://money.cnn.com/2013/05/01/pf/kids-money.moneymag/

http://money.cnn.com/2013/05/01/pf/kids-money.moneymag/

May 16, 2013

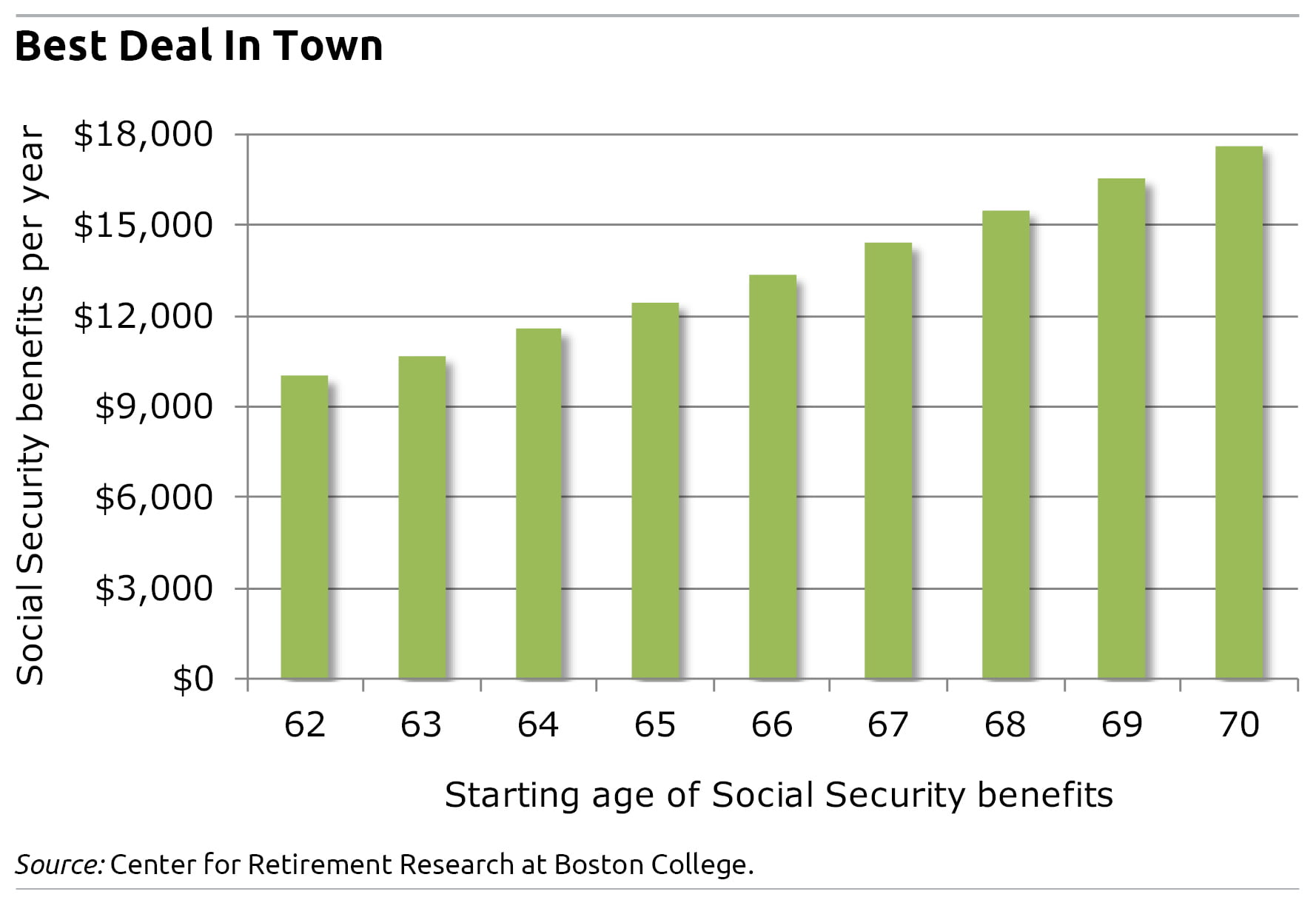

Delaying Social Security “is the best deal in town”

You can’t always get what

you want. But if you try sometimes you just might find you get what you

need. Rolling Stones, 1969.

“There is nothing better

that most people can do to get what they’ll need in retirement than delaying

when they start collecting Social Security.”

According to analysis by the Center for Retirement Research, the payoff

for delaying claiming Social Security retirement benefits is “enormous.” For example, “take someone who’s 60 and could

get $10,000 per year by claiming Social Security today. That would increase to

more than $13,000 per year by waiting until 66 and to more than $17,000 by

waiting until 70.” Read the details on

the Squared Away blog: http://squaredawayblog.bc.edu/squared-away/getting-what-you-need-for-retirement/

Subscribe to:

Comments (Atom)