"COLLEGE STUDENTS who borrow graduate with an average $37,000 in loans. While many people believe loans are the only way to finance a college education, that’s simply not the case."

Author Kristine Hayes is a departmental manager at a small, liberal arts college.

Here are five ways to get an advanced education while minimizing debt:"

1. Stay close to home.

2. Comparison shop. On paper, private schools typically appear to cost more than public institutions, but it’s worth digging into the details.

3. Scholarships. Billions of dollars in scholarships are given to college students every year.

4. Condensed degree programs.

5. Tap your employer. Some employers offer tuition reimbursement programs

"Many hospitals offer these types of programs for students interested in nursing. It’s even possible to attend medical school for free. Kaiser Permanente recently announced that the first five cohorts of students to attend its new medical school will pay no tuition. With medical doctors typically graduating with nearly $200,000 in debt, Kaiser’s program will no doubt generate significant interest."

Read the full article for details: https://humbledollar.com/2019/09/educated-consumers/

September 21, 2019

How to afford college

Labels:

college,

college costs,

college financial aid

10 Alternate Ways to Pay for Long-Term Care

10 Alternate Ways to Pay for Long-Term Care

Don't count on Medicare to pay for nursing home, assisted living or ongoing home health care. Medicare benefits for that type of care are typically only available after a hospitalization or injury and for a limited duration. While Medicare isn't an option, here are 10 alternatives that are:

• Group Long-Term Care Insurance

• Group Long-Term Care Insurance

• Short-Term Care Insurance

• Life/Long-Term Care Insurance

• Health Savings Accounts

• Long-Term Care Annuities

• Life Plan Communities

• Veterans Benefits

• Home Equity

• Pensions or Social Security

• Medicaid

Source: https://money.usnews.com/money/personal-finance/family-finance/articles/the-high-cost-of-long-term-care-insurance-and-what-to-use-instead

Don't count on Medicare to pay for nursing home, assisted living or ongoing home health care. Medicare benefits for that type of care are typically only available after a hospitalization or injury and for a limited duration. While Medicare isn't an option, here are 10 alternatives that are:

• Group Long-Term Care Insurance

• Group Long-Term Care Insurance• Short-Term Care Insurance

• Life/Long-Term Care Insurance

• Health Savings Accounts

• Long-Term Care Annuities

• Life Plan Communities

• Veterans Benefits

• Home Equity

• Pensions or Social Security

• Medicaid

Source: https://money.usnews.com/money/personal-finance/family-finance/articles/the-high-cost-of-long-term-care-insurance-and-what-to-use-instead

Labels:

Long Term Care,

Long Term Care Insurance

September 18, 2019

Retirement Income Security Evaluation Score (RISE Score™)

Retirement Income Security Evaluation (RISE)

“evaluates just where you fall in terms of having steady income in retirement, much like a credit score, on a zero to 850 scale.”

“Consumers can access the tool online. After inputting factors such as the Social Security income you expect, any pension income you may have, how much you have saved and your monthly living and medical expenses, you can see how well you will fare financially in retirement.”

The tool is aimed at individuals ages 45 and up with investable assets of $75,000 to $2 million.

Check out the RISE score at: https://www.retireyourrisk.org/rise-score/

“The purpose of the Retirement Income Security Evaluation Score (RISE Score™) is to provide you with an estimated measure of income security to help you determine whether you're on track with your current retirement income plans. The RISE Score™ can help you assess how well your retirement portfolio will cover basic living expenses and health care costs in retirement. The RISE Score™ is also designed to help answer this simple question: How can my retirement security potentially be improved through the addition of lifetime income solutions in my retirement planning strategy?”

“evaluates just where you fall in terms of having steady income in retirement, much like a credit score, on a zero to 850 scale.”

“Consumers can access the tool online. After inputting factors such as the Social Security income you expect, any pension income you may have, how much you have saved and your monthly living and medical expenses, you can see how well you will fare financially in retirement.”

The tool is aimed at individuals ages 45 and up with investable assets of $75,000 to $2 million.

Check out the RISE score at: https://www.retireyourrisk.org/rise-score/

“The purpose of the Retirement Income Security Evaluation Score (RISE Score™) is to provide you with an estimated measure of income security to help you determine whether you're on track with your current retirement income plans. The RISE Score™ can help you assess how well your retirement portfolio will cover basic living expenses and health care costs in retirement. The RISE Score™ is also designed to help answer this simple question: How can my retirement security potentially be improved through the addition of lifetime income solutions in my retirement planning strategy?”

September 12, 2019

Don't wait to install solar panels

"Installing solar panels is expensive, but if you have the money, now might be the time to act. That’s because the investment tax credit, which offers significant deductions for installing a solar energy system, is set to expire soon."

"If your system is hooked up and running before the end of the year, you’ll be able to deduct 30 percent of the installation costs from your tax bill. In 2020, the tax credit will fall to 26 percent. In 2021, it drops to 22 percent, and, in 2022, it will be phased out for residential customers."

"If your system is hooked up and running before the end of the year, you’ll be able to deduct 30 percent of the installation costs from your tax bill. In 2020, the tax credit will fall to 26 percent. In 2021, it drops to 22 percent, and, in 2022, it will be phased out for residential customers."

Source: NYTimes.com/climate

"If your system is hooked up and running before the end of the year, you’ll be able to deduct 30 percent of the installation costs from your tax bill. In 2020, the tax credit will fall to 26 percent. In 2021, it drops to 22 percent, and, in 2022, it will be phased out for residential customers."

"If your system is hooked up and running before the end of the year, you’ll be able to deduct 30 percent of the installation costs from your tax bill. In 2020, the tax credit will fall to 26 percent. In 2021, it drops to 22 percent, and, in 2022, it will be phased out for residential customers."Source: NYTimes.com/climate

September 3, 2019

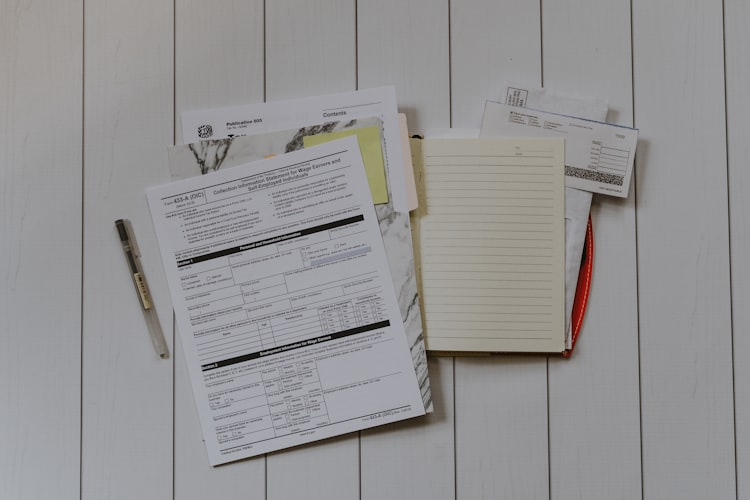

Small IRA, 401(k) differences can lead to big tax consequences

Writing for The Wall Street Journal, tax expert Laura Saunders explains the necessity of carefully reading the tax rules that affect the use of IRA and 401(k) funds. Failure to adhere to IRS regulations can result in a large unexpected tax bill. Especially if you are taking an early withdrawal, double check advice from a tax professional to ensure you won't owe a tax penalty.

"Because tax-favored retirement accounts are supposed to be for

retirement, the rules often impose tax and a 10% penalty on withdrawals

before age 59½. Younger IRA owners who take out up to $10,000 to

purchase a first home don’t owe the penalty, while younger 401(k)

participants do."

"Because tax-favored retirement accounts are supposed to be for

retirement, the rules often impose tax and a 10% penalty on withdrawals

before age 59½. Younger IRA owners who take out up to $10,000 to

purchase a first home don’t owe the penalty, while younger 401(k)

participants do."

“The IRA and 401(k) rules are full of these booby-traps, and they hurt a lot of smart people who aren’t retirement experts,” says Natalie Choate, an attorney and retirement-plan specialist.

Education-expense withdrawals. Payouts before age 59½ from an IRA that are used for higher-education tuition, books and other costs are exempt from the 10% penalty. Similar withdrawals from 401(k) plans incur it.

Age 55—59½ payouts. Savers don’t owe the 10% penalty on withdrawals from a 401(k) before age 59½ if they were at least 55 in the year they left their job. But a 10% penalty applies to IRA withdrawals before the owner is 59½, except for certain exemptions.

Borrowing. Many 401(k) plans allow participants to borrow from them. Borrowing against an IRA is prohibited.

Creditor protection. Employer-provided plans such as 401(k)s are better shielded from creditors than are IRAs.

"Because tax-favored retirement accounts are supposed to be for

retirement, the rules often impose tax and a 10% penalty on withdrawals

before age 59½. Younger IRA owners who take out up to $10,000 to

purchase a first home don’t owe the penalty, while younger 401(k)

participants do."

"Because tax-favored retirement accounts are supposed to be for

retirement, the rules often impose tax and a 10% penalty on withdrawals

before age 59½. Younger IRA owners who take out up to $10,000 to

purchase a first home don’t owe the penalty, while younger 401(k)

participants do."“The IRA and 401(k) rules are full of these booby-traps, and they hurt a lot of smart people who aren’t retirement experts,” says Natalie Choate, an attorney and retirement-plan specialist.

Education-expense withdrawals. Payouts before age 59½ from an IRA that are used for higher-education tuition, books and other costs are exempt from the 10% penalty. Similar withdrawals from 401(k) plans incur it.

Age 55—59½ payouts. Savers don’t owe the 10% penalty on withdrawals from a 401(k) before age 59½ if they were at least 55 in the year they left their job. But a 10% penalty applies to IRA withdrawals before the owner is 59½, except for certain exemptions.

Borrowing. Many 401(k) plans allow participants to borrow from them. Borrowing against an IRA is prohibited.

Creditor protection. Employer-provided plans such as 401(k)s are better shielded from creditors than are IRAs.

Labels:

401(k),

income tax,

IRA,

taxes

Losing your privacy through medical data smart phone apps

As a Wall Street Journal reader I am reminded almost daily of the loss of privacy linked to the use of computers, smart phones, and other technology. Facebook is one of the worst offenders.

But now Natasha Singer, writing in The New York Times reveals the perils of smart phone apps for medical data.

But now Natasha Singer, writing in The New York Times reveals the perils of smart phone apps for medical data.

"Americans may soon be able to get their

medical records through smartphone apps as easily as they order takeout

food from Seamless or catch a ride from Lyft."

"But

prominent medical organizations are warning that patient data-sharing

with apps could facilitate invasions of privacy — and they are fighting

the change."

The American Medical Association is warning that patients "who authorized consumer apps to retrieve their medical records could

open themselves up to serious data abuses. Federal privacy protections,

which limit how health providers and insurers may use and share medical

records, no longer apply once patients transfer their data to consumer

apps."

So think twice before signing up to get your medical info on your smart phone.

Labels:

data privacy,

medical,

privacy

Subscribe to:

Comments (Atom)